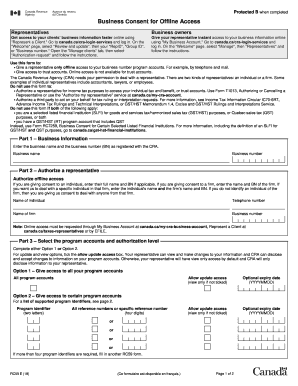

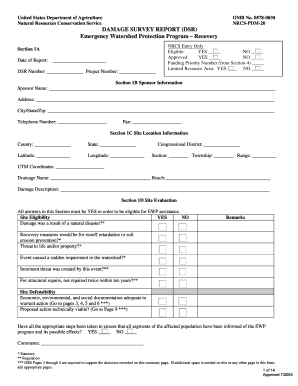

Canada RC59 E 2007 free printable template

Show details

RC59 E (07). Part 3 Which Accounts ... identifiers are needed complete another RC59. To ... BUSINESS CONSENT FORM (RC59 continued) ii) Details of ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada RC59 E

Edit your Canada RC59 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada RC59 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada RC59 E online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Canada RC59 E. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada RC59 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada RC59 E

How to fill out Canada RC59 E

01

Start by downloading the Canada RC59 E form from the official Canada Revenue Agency (CRA) website.

02

Fill in your personal information in the designated sections, including your name, address, and contact information.

03

Provide your Social Insurance Number (SIN) or Business Number if applicable.

04

Specify the type of tax information changes you are requesting.

05

If required, include any supporting documentation that may validate your request.

06

Review the information you have entered to ensure it is accurate and complete.

07

Sign and date the form where indicated.

08

Submit the completed form by mailing it to the address provided in the instructions.

Who needs Canada RC59 E?

01

Individuals or businesses who need to request a change to their tax information or update their personal information with the Canada Revenue Agency.

02

Those who have had a change in their personal status, such as a change of address, marital status, or significant life events that affect their tax situation.

Fill

form

: Try Risk Free

People Also Ask about

What form do I need to authorize a representative CRA?

By signing Form AUT-01, Authorize a Representative for Offline Access, you are authorizing the representative to have access to information regarding trust accounts. Send the form to the appropriate CRA tax centre listed on the form within six months of the date it is signed.

What replaced RC59?

CRA replaces RC59 with Form AUT-01 Authorize a Representative for Access by Phone and Mail - Canadian Charity Law.

What is an RC59 form?

The RC59 (Corporate Form) is a CRA issued form used by businesses to give someone such as an accountant or lawyer access to their confidential business information.

What is CRA form RC59?

Notice to the reader: You can now authorize your representative online using My Business Account. Your Business Consent form must be properly completed before the CRA can process your request. Incomplete forms will not be processed and will be returned to you.

What is RC59 form?

The RC59 (Corporate Form) is a CRA issued form used by businesses to give someone such as an accountant or lawyer access to their confidential business information.

Can I still use RC59?

You can also request an electronic signature on this form. The CRA no longer accepts forms RC59 (Business Consent for Offline Access) and RC59X (Cancel Business Consent or Delegated Authority).

What is the replacement for RC59?

CRA replaces RC59 with Form AUT-01 Authorize a Representative for Access by Phone and Mail. CRA has said that they will no longer accept the RC59 Business Consent for Offline Access and now as of today one will need to use the new Form AUT-01 Authorize a Representative for Access by Phone and Mail.

How do I authorize a business representative for CRA?

To authorize a representative to have offline access to your: Business account information, use Form AUT-01, Authorize a Representative for Offline Access, and mail the form to the appropriate CRA tax centre listed on the form within six months of the date it is signed.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit Canada RC59 E straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing Canada RC59 E.

How do I fill out the Canada RC59 E form on my smartphone?

Use the pdfFiller mobile app to fill out and sign Canada RC59 E on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Can I edit Canada RC59 E on an Android device?

You can make any changes to PDF files, such as Canada RC59 E, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is Canada RC59 E?

Canada RC59 E is a form used to authorize a representative to deal with the Canada Revenue Agency (CRA) on behalf of a taxpayer regarding certain tax matters.

Who is required to file Canada RC59 E?

Individuals or businesses who wish to designate a representative, such as an accountant or tax advisor, to communicate with the CRA regarding their tax affairs must file the Canada RC59 E form.

How to fill out Canada RC59 E?

To fill out Canada RC59 E, provide your personal or business details, the representative's information, and clearly specify the types of tax matters you are authorizing the representative to handle, then sign and date the form.

What is the purpose of Canada RC59 E?

The purpose of Canada RC59 E is to grant permission for a designated representative to receive information and communicate with the CRA on behalf of the taxpayer regarding their tax obligations.

What information must be reported on Canada RC59 E?

The information that must be reported includes the taxpayer's and the representative's names, addresses, phone numbers, the type(s) of tax matters they are authorized for, and the duration of the authorization.

Fill out your Canada RC59 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada rc59 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.